Bank Of America Check Deposit

If you bank at Bank of America, never make an ATM deposit there, especially if the money’s coming from another bank. Here’s why…

/free-check-cashing-315472-FINAL-5bbd18d046e0fb00266f6fcb.png)

I’m a Bank of America account-holder, which is to say I’ve also been a Bank of America hostage.

For the last week, Bank of America has held a $2,080 deposit of mine — written by my business partner off her account with another bank — as “delayed.” For a week. For seven days, Bank of America customer service agents either wouldn’t or couldn’t explain why I could not access money that was properly deposited and is MY money.

Until last night.

- Bank of America Credit account (Credit card, charge card, loan, line of credit) 11:59 p.m. ET for same-day credit. Bank of America Mortgage: For customers who pay with their Bank of America Checking or Savings account, 5:00 p.m. ET cutoff time gives you same-day credit: Bank of America Vehicle loans.

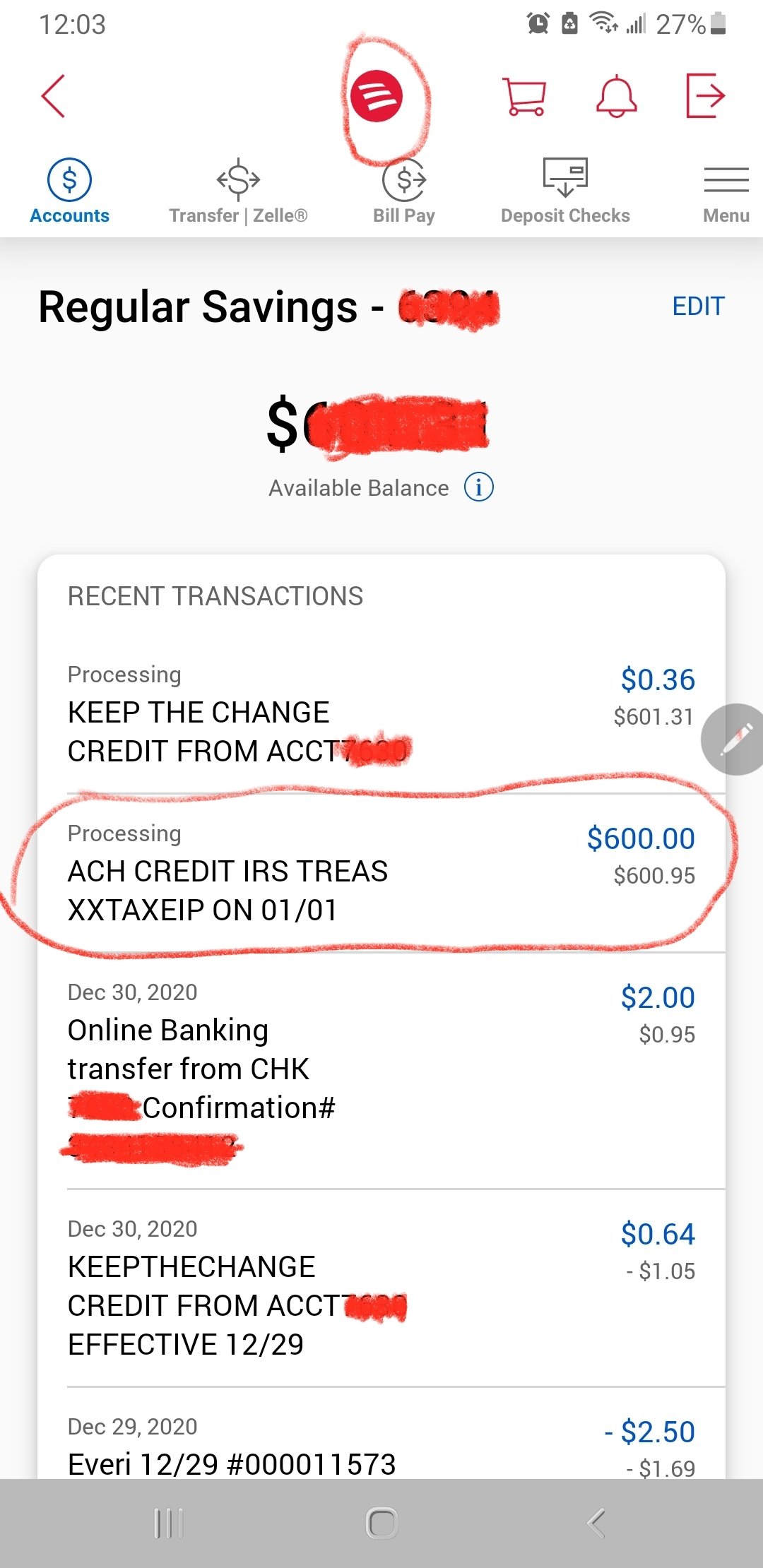

- Others will receive paper checks or prepaid debit cards in the mail, at the address that the IRS has on file for that individual. Banks, including Bank of America, cannot and do not provide personal account or address information to the IRS. Direct deposits are posted for open accounts on the effective date set by the Treasury.

After I raised a stink on social media (which is a #WiseStrategy you should read about here), a very professional BofA social media agent reached out. She explained to me that because I deposited the check via an ATM inside my neighborhood Bank of America branch and because the check was an unusual amount ($2,080? Not exactly a fortune) written from another bank’s account, it triggered a 7-day delay in making the funds available.

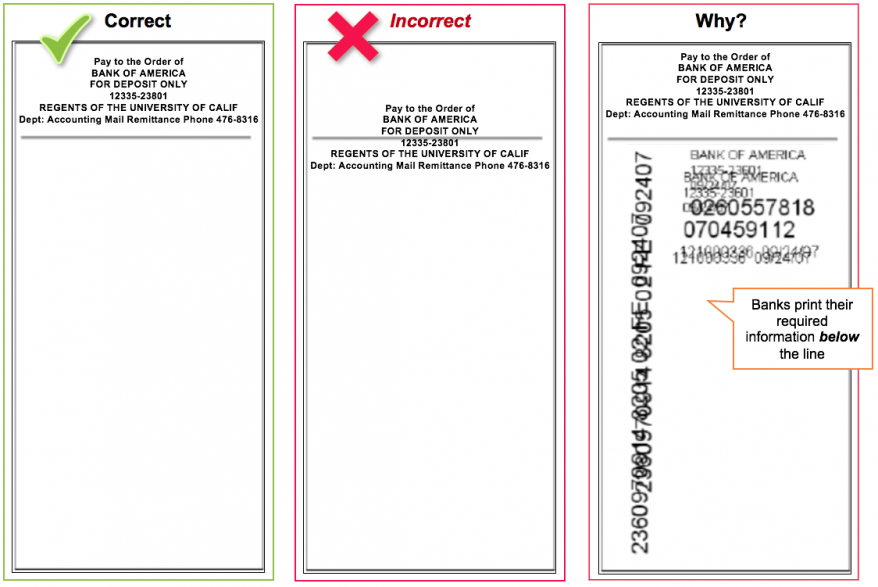

Bank of America offers remote depositing in accordance with the Check Clearing for the 21st Century Act (Check 21). This law permits banks to truncate original checks, process check information electronically, and deliver substitute checks to banks that want to continue receiving paper checks. Bank of America’s Small Business Remote Deposit.

Well, that triggered me — not only because my own bank was holding my money hostage, but also because my bank may have violated federal law.

According to BankRate.com, federal regulations require that local funds deposited via an ATM must be made available no later than the second business day after the deposit, as long as the check was deposited on a banking day (mine was a non-holiday Monday), and the check was deposited in an ATM owned by the depositor’s bank (it was). Non-local checks can be held for five business days, but not a day longer.

As if she were doing me a favor, the BofA social media agent proudly announced she would release my funds to me, even though BofA sent me a notice that it intended to delay the deposit as long as eightbusiness days — again, in violation of federal regulations according to BankRate.com.

Of course, I have neither the time nor the money to sue Bank of America. But I do have my blog and the bully pulpit of Wise Choices…and I will soon be taking my banking elsewhere.

Just so you know, here’s BankRate.com’s summary of federal regulations regarding the availability of deposited funds:

- Banks must post or provide a notice at each ATM location that funds deposited in the ATM may not be available for immediate withdrawal.

- If a bank makes funds from deposits at an ATM it doesn’t own available for withdrawal later than funds from deposits at an ATM it does own, it must provide a description of how the customer can tell the difference between the two ATMs.

- If you deposit money in an ATM that isn’t owned by your bank, the funds must be available for withdrawal not later than the fifth business day following the banking day on which the funds are deposited.

- Funds deposited at an ATM that is not on or within 50 feet of the premises of the bank are considered deposited on the day funds are removed from the ATM, if funds are not normally removed from the ATM more than two times each week.

- A bank that operates an off-premises ATM from which deposits are not removed more than two times each week must disclose at or on the ATM the days on which deposits made at the ATM will be considered received.

- Funds deposited at a staffed facility, ATM or contractual branch are considered deposited when they are received at the staffed facility, ATM or contractual branch.

Bank Of America Check Deposit By Mail Address

Copyright 2018 Wise Choices TM. All rights reserved.