Bank Of America Check Deposit Time

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.

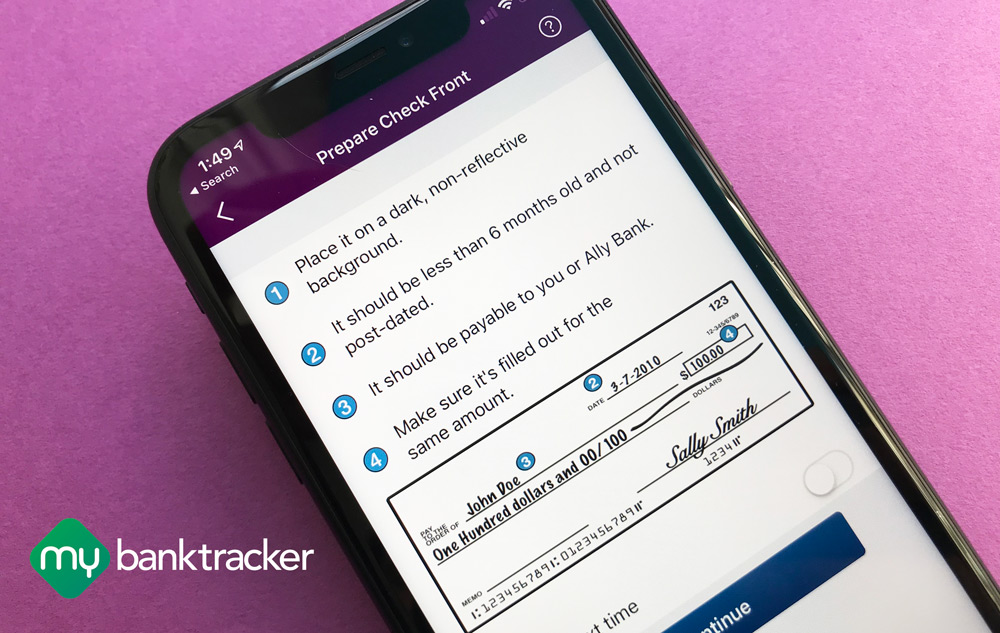

Perhaps your bank typically makes funds available the same business day that a check is deposited. If you go into a branch of your bank to deposit a check at 3 p.m., but its cutoff time is 2 p.m., your check won’t be processed until the following day. The deposit date will be postponed until the next business day, and so will your funds. Check costs can vary depending on the style of check you choose. Also, Preferred Rewards clients and certain account types qualify for free standard check styles and discounts on non-standard styles. To view check costs and explore a full catalog of checks and related products, sign in to Online Banking to order checks or deposit tickets. For more information about fees and pricing for your. Bank of America’s ATMs let account holders deposit checks without using a deposit slip. The ATMs also accept multiple checks at once. Completing your Bank of America ATM check deposit gets you out of the bank line and saves you some time for other errands and things you might prefer to be doing. Bank of America offers remote depositing in accordance with the Check Clearing for the 21st Century Act (Check 21). This law permits banks to truncate original checks, process check information electronically, and deliver substitute checks to banks that want to continue receiving paper checks. Bank of America’s Small Business Remote Deposit.

If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.

For mobile deposits, the cut-off time is often later (e.g., 5 p.m. If a bank or credit union is open for business on Saturday or Sunday, it is not required to consider those business days for the purpose of funds availability. Longer Holds on Deposits. Regulation CC provides six exceptions to the hold periods for deposited checks.

Also, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us.

Bank Of America Cash Deposit Rules

Bank Of America Pending Deposits

Check Deposit Delayed Bank Of America

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs.