Direct Deposit Account

Direct deposit is the fastest way to get your paycheck into your checking account. Several banks make this process even faster by implementing early direct deposit features. What Is Direct Deposit? Direct deposit is an electronic payment from one bank account to another. For example, money may move from an employer’s bank account to an employee’s bank account, although there are several other ways to use direct deposit.

Direct Deposit Account Type

Taxpayers who did not have direct deposit information on record with the IRS can now enter or change that info on the IRS website Get My Payment tool.

- With Direct Deposit, electronic payments are made directly into your bank account — there’s no check, and no trip to the bank. It’s just a predictable way of receiving money, and a more convenient way of benefiting from digital tools and money management apps that can help you budget.

- The third set is the one you don't need for direct deposit, as it's the number of the individual check. Check this IRS page for more help with locating your routing and account numbers.

- Dec 23, 2020 The new direct deposit limits will help eliminate this type of abuse. Direct deposit must only be made to accounts bearing the taxpayer’s name. Preparer fees cannot be recovered by using Form 8888 PDF to split the refund or by preparers opening a joint bank account with taxpayers.

Note: We've noticed a lot of people visiting this article, which was from the first Coronavirus stimulus payments back in April 2020. For the latest on the likely second coronavirus stimulus payments, in December (or early January 2021), vist our Covid News page:

https://www.cpapracticeadvisor.com/covid-19

Ss Direct Deposit Account Information Page

The IRS has added new features to the “Get My Payment” tool on its website to help more taxpayers receive and track their coronavirus stimulus payments. Taxpayers who did not have direct deposit information on record with the IRS can now enter or change that info on the IRS website Get My Payment tool.

The enhancements, which started last week and continued through the weekend, adjusted several items related to the online tool, which debuted on April 15. The additional changes will help millions of additional taxpayers with new or expanded information and access to adding direct deposit information.

“We delivered Get My Payment with new capabilities that did not exist during any similar relief program, including the ability to receive direct deposit information that accelerates payments to millions of people,” said IRS Commissioner Chuck Rettig. “These further enhancements will help even more taxpayers. We urge people who haven’t received a payment date yet to visit Get My Payment again for the latest information. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.”

“We encourage people to check back in and visit Get My Payment,” Rettig added. “These enhancements will help many taxpayers. By using Get My Payment now, more people will be able to get payments quickly by being able to add direct deposit information.”

How to use Get My PaymentAvailable only on IRS.gov, the online application is safe and secure to use. Taxpayers only need a few pieces of information to quickly obtain the status of their payment and, where needed, provide their bank account information. Having a copy of their most recent tax return can help speed the process.

Free Direct Deposit Account

As a reminder, Get My Payment is a U.S. Government system for authorized use only. The tool is solely for use by individuals or those legally authorized by the individual to access their information. Unauthorized use is prohibited and subject to criminal and civil penalties.

- For taxpayers to track the status of their payment, this feature will show taxpayers the scheduled delivery date by direct deposit or mail and the last four digits of the bank account being used if the IRS has direct deposit information. They will need to enter basic information including:

- Social Security number

- Date of birth, and

- Mailing address used on their tax return.

- Taxpayers needing to add their bank account information to speed receipt of their payment will also need to provide the following additional information:

- Their Adjusted Gross Income from their most recent tax return submitted, either 2019 or 2018

- The refund or amount owed from their latest filed tax return

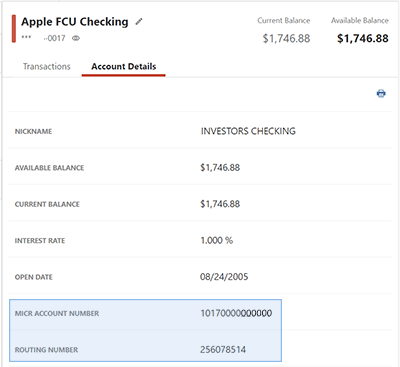

- Bank account type, account and routing numbers

Direct Deposit Account Online

Get My Payment cannot update bank account information after an Economic Impact Payment has been scheduled for delivery. To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS.

A Spanish version of Get My Payment is expected in a few weeks.

Direct Deposit Account For Stimulus Check

Watch out for scams related to Economic Impact Payments The IRS urges taxpayers to be on the lookout for scams related to the Economic Impact Payments. To use the new app or get information, taxpayers should visit IRS.gov. People should watch out for scams using email, phone calls or texts related to the payments. Be careful and cautious: The IRS will not send unsolicited electronic communications asking people to open attachments, visit a website or share personal or financial information. Remember, go directly and solely to IRS.gov for official information.