Indusind Bank Savings Account Interest Rate

A Savings Account is very beneficial with multiple advantages as detailed below:

- What Is The Interest Rate On Fd In Indusind Bank

- Indusind Bank Savings Account Interest Rate Singapore

- Indusind Bank Savings Account Interest Rate Comparison

- What Is The Interest Rate Of Indusind Bank

- Indusind Bank Savings Account Interest Rate Calculator

- Indusind Fd Rates

- Indusind Bank Savings Account Interest Rate 2020

(1) Earns Interest on your Savings

This is the first and foremost benefit of opening a savings account. It starts earning interest on your money as soon as it is deposited. The interest rate is decided solely by the bank and changes from time to time. Regular interest depends upon the balance of the savings account.

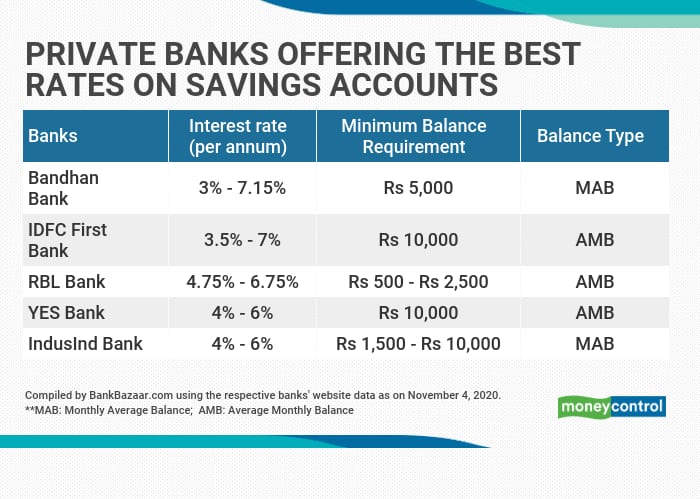

However, with the changes in other banking products, savings account has also seen a major shift from being minimum balance account to zero balance savings account. Many banks now offer zero balance savings account with high-interest rate which is more in demand as compared to the age-old pattern of keeping a few thousands in bank account to. IndusInd Bank Savings Account Interest Rate. The interest rates offered with IndusInd Bank Savings Account are as follows: For daily balance up to Rs 1 lakh it is 4% p.a. For daily balance above Rs 1 lakh and below Rs 10 lakhs it is 5% p.a. For daily balance above Rs 10 lakhs it is 6% p.a. Types of IndusInd Bank Savings Account.

Interest rate in savings account ranges from 3.5% to 7%.

(2) Provides Security of Funds

There is no risk involved in your savings account. It is considered as one of the safest investment alternatives. It even offers you the opportunity to put your money into another investment whenever the time comes.

(3) No Lock-in Period

There is no lock-in period under savings account which means that you can withdraw your deposits anytime you need. There is no need to keep your money in this account for any specific period. You have full flexibility in withdrawal of amount from it.

(4) Offers Liquidity

You can withdraw the amount anytime 24X7 with the use of ATM card or debit card from your account during any emergency even when the bank is closed. In fact, being able to access your money when you need it, is one of the biggest benefit of having a savings account.

(5) Availability of Variety of Savings Account

Many banks offer comprehensive range of savings accounts from regular to premium suiting to your personal banking needs. There are different types of savings accounts offered by various banks that differ based on the interest rates and duration of time commitments. You can choose any of them which suits your financial objectives and requirements.

(6) Services of Customer Relation Manager

What Is The Interest Rate On Fd In Indusind Bank

Now-a-days many of the banks engage a Customer Relation Manager (CRM) who will help not only solve your queries but also assist you in tax saving, investment, mutual fund schemes, insurance, bank procedures, etc. You need to just call your CRM and he/ she will assist you solve your problem.

(7) Online Banking Facilities

If you maintain a savings account, you can make many transactions online also such as payment of bills, fund transfers using RTGS/ NEFT or IMPS, etc. This will save your time and efforts.

(8) Provides ATM/ Debit Card

You will be offered a debit or ATM card with a nominal charge or without any charges, as offered by your bank. With the help of this card, you can withdraw the funds, make transactions in shops, make payments of bills, etc.

(9) Helps you Get Credit or Loan

The relation you maintain with the bank will help you in getting credits from the bank such as home loan, personal loan. You will also be in a position to negotiate with the banker on the interest rates.

(10) No Cap on Deposits

There is no limit on the amount deposited and number of times it is deposited.

(11) Facility to link Loan EMIs, Mutual Fund SIPs or RD deductions

You get a facility to link your monthly loan EMIs, Mutual Fund SIPs or RD deductions through the savings bank account.

(12) Free Mobile App

Most of the banks provide their mobile app for free. Through this app, you can get to know your account balance, check your statement, make transactions, easy transfer of money, etc.

Indusind Bank Savings Account Interest Rate Singapore

Individual Savings Account

Indusind Bank Savings Account Interest Rate Comparison

Enhancing And Encouraging Saving Standards Through Innovation

We, at IndusInd Bank, have dedicated ourselves to present the best savings bank account programmes for you and your family. We present a set of creatively crafted savings accounts that provide a host of banking benefits including reward points for active transactions, privilege and lifestyle offers, trading and portfolio solutions, flexible fund management, special banking facilities for senior citizens, along with competitive savings account interest rate for value added returns.

What Is The Interest Rate Of Indusind Bank

Get convenient account access from around the world, make quick utility bill payments, enjoy free NEFT and RTGS facilities, and be privy to other such banking options that will enhance and elevate your banking experience.

Indusind Bank Savings Account Interest Rate Calculator

As an IndusInd Bank savings account customer, you receive the latest features in convenience banking. Some of the many benefits of banking with us include:

My Account My Number: Personalize your savings account number by choosing your own digits through the MAMN facility. It allows you to easily recollect your account number during on-the-go phone and net banking sessions.

Choice Money: This option enables you to withdraw cash in the denomination of your choice from all IndusInd Bank ATMs. This service is also available to non-IndusInd Bank customers.

Jump the Queue!: No IVR interruptions. IndusInd Select and IndusInd Exclusive savings accounts let you directly reach out to our phone banking executives and Relationship Managers for all your queries and banking assistance.

Check on Cheque: Receive a picture of every cheque that you issue from your IndusInd Bank account along with your bank statement. This is a first-of-its kind service provided by IndusInd Bank to help you keep track of your issued cheques.

Video Branch: You can now communicate with our Branch Managers, Relationship Managers, and centralised Video Branch Executives through our secure video branch. Carry out Fixed Deposit, Recurring Deposit, NEFT, RTGS transactions and much more from anywhere in the world.

Social Banking: Stay connected to your IndusInd Bank account through Facebook. Check your balance, get mini-statements, recharge your mobile and DTH. Also, use Quickpay to send money to your Facebook and non-Facebook friends.

Higher Interest Rate: Enjoy interest rates of up to 6% on your savings with IndusInd Bank.

Insurance: We assure your financial independence through our complimentary insurance policies, safeguarding you against the ever-increasing, individual risks.

Lifestyle: Besides the innovative banking features, your IndusInd Bank account provides you the finest lifestyle and leisure privileges, such as discounts on movie tickets at BookMyShow, offers at leading spas, etc.

Walk into your nearest IndusInd Bank branch or open a savings account online with an Account Number of your choice with the added advantage of a quick and hassle-free doorstep documentation process.

Indusind Fd Rates

Read MoreApply NowIndusind Bank Savings Account Interest Rate 2020

Open your account online instantly basis your Aadhaar number and PAN Card and get access to a world of privileges with Indus Online Savings Account

- Open account instantly using Aadhaar and PAN

- Get instant access to mobile banking and start using your account

- Get amazing offers with the All in one store on the Indus Mobile App

- No minimum balance required based on the variant chosen

Designed with the top-of-the-line privileges and offers along with our best personnel to ensure that you experience a whole new level of banking

- Lifetime free Platinum Exclusive Debit Card

- Buy one and get one free movie ticket from Bookmyshow

- Upto 100% discount on first year fee of Standard Locker*

A premier banking program designed with an array of privileges and lifestyle offers

- Lifetime free Platinum Select Debit Card

- Buy one and get one free movie ticket from Bookmyshow

- Upto 50% discount on first year fee of Standard Locker*

Gives you a host of premium & exclusive services with IndusInd Maximum Platinum Debit Card

- Two free add-on accounts

- Platinum Debit Card free on add-on accounts

A premier savings account with a host of exclusive benefits and a feature rich Titanium Plus debit card

- Titanium Plus Card with Book My Show Offer

- 25% Discount on Lockers

A privilege account with a set of exclusive features that offer more value for your money

- Free Indus Young Savers Account

- Cashback through Indus Money Program

A savings account that rewards you ,for doing transactions and being active

- Choose the account number of your choice

- Specially crafted Platinum Plus Debit Card

Maximum Benefits Accounts specially crafted for progressive Woman of today

- 25% discount on first year fee of Standard Locker

- Free add-on account for family

An Ideal account for the experienced and respected senior citizens

- 0.5% additional interest on Fixed Deposit

- Insurance and medical discounts

A unique 3-in-1 proposition for e-trading in the Indian capital markets

- Trading functionality

- Access to world class advisory/research by our broking partner

A balanced portfolio of savings and investment solutions for your child

- Cheque book on your child’s name

- Personalised Debit Card

Gives the flexibility to manage your funds between your Savings Account and Fixed Deposits

- Reward points on every card transaction

- Free monthly e-statement

Gives you the maximum benefits with minimum requirements.

- Free ATM card

- Free monthly e-statement

Gives you the maximum benefits at zero balance requirements.

- Free ATM Card

- 5 Free domestic other bank ATM transactions in a month