Pnb Saving Account Interest Rate

- High Savings Account 3% Apy

- Pnb Saving Account Interest Rate 2021

- Pnb Saving Account Interest Rate 2020

- 7% Interest Rate Savings Account

- Saving Account Interest Rates Pnb

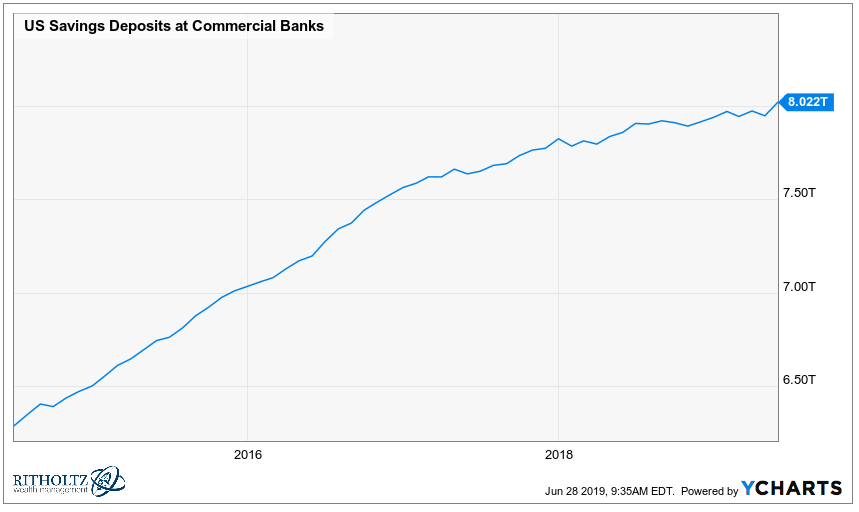

UK savers have £215.3bn sat in savings accounts which don’t pay any interest at all, according to the latest figures from the Bank of England.

PNB Dollar Savings Account allows deposit and withdrawal at any PNB branch nationwide. Balance Requirements. Initial Deposit. PNBig is a special savings account that earns higher interest rates than regular savings accounts. These competitive rates allow you to maximize your earnings. Monitoring your placements is made easy through the accompanying passbook. Features: Tiered interest rates depending on the term; Comes with a passbook; Initial deposit: P25,000.00. PNB Top Saver Account A unique savings account that allows you to earn more as you save more. Grow your interest rate up to a maximum of 0.500%. Your PNB Top Saver Account comes with a passbook or PNB-PAL Mabuhay Miles Debit Card.

The figures are from the end of October 2020, so this total could have increased since then, and it’s all gradually getting eroded by the effects of inflation.

There’s no reason to let this happen – while it’s true that savings rates are very low at the moment, it’s still possible to get a return on your cash.

Here, Which? reveals how your savings can earn more and where to find the best rates.

Where can you find the top-rate savings accounts?

This series of tables set out the top rates for different types of savings accounts and cash Isas.

The links will take you through to Which? Money Compare, where available.

Fixed-rate accounts

Opting for a fixed-rate account means that you’ll usually be able to secure the highest interest rates on the market and keep them for a set amount of time, regardless of what happens to the savings market in the meantime.

With rumours of further interest rate cuts to come, opting for a fixed-rate account now could put you in good stead. However, you’ll need to make sure you can commit to keeping your savings locked up for the full term.

The table below shows the top-rate accounts for savings and cash Isas by order of term.

| Account | AER | Terms |

| Punjab National Bank Five-Year Fixed-Term Deposit savings account | 1.4% | £1,000 minimum initial deposit |

| Punjab National Bank Five-Year Fixed-Term Cash Isa | 1.2% | £1,000 minimum initial deposit |

| Punjab National Bank Four-Year Fixed-Term Deposit savings account | 1.3% | £1,000 minimum initial deposit |

| Punjab National Bank Four-Year Fixed-Term Cash Isa | 1.1% | £1,000 minimum initial deposit |

| Punjab National Bank Three-Year Fixed-Term Deposit savings account | 1.2% | £1,000 minimum initial deposit |

| Punjab National Bank Three-Year Fixed-Term Cash Isa | 1% | £1,000 minimum initial deposit |

| Punjab National Bank Two-Year Fixed-Term Deposit savings account | 1.1% | £1,000 minimum initial deposit |

| Punjab National Bank Two-Year Fixed-Term Cash Isa | 0.9% | £1,000 minimum initial deposit |

| Punjab National Bank One-Year Fixed-Term Deposit savings account | 0.9% | £1,000 minimum initial deposit |

| Punjab National Bank One-Year Fixed-Term Cash Isa | 0.7% | £1,000 minimum initial deposit |

Source: Moneyfacts. Correct as of 7 January 2021, but rates are subject to change.

As the table shows, Punjab National Bank is currently offering the top rates across the board. You’ll need at least £1,000 to open any of these accounts, and for every term the savings account pays 0.2% more interest than its cash Isa equivalent.

However, remember that savings interest earned in cash Isas is tax-free – if you’re likely to exceed your personal savings allowance, this could be much more valuable than 0.2% extra interest.

- Find out more:how to find the best cash Isa

Top instant-access accounts

If you can’t lock your money away, an instant-access account usually offers the most flexibility – but rates aren’t usually as high as fixed-rate accounts and can be reduced at any time.

However, if your rate is reduced and no longer competitive, it should be easy enough to switch to a new account whenever you like.

The table below shows the five top-rate instant-access savings accounts and cash Isas.

| Account | AER | Terms |

| Al Rayan Bank Instant-Access Cash Isa | 0.6% (EPR*) | £50 minimum initial deposit |

| Earl Shilton Building Society Instant-Access Cash Isa | 0.6% | £10 minimum initial deposit. Only available to people living within the postcode areas of LE, CV9-13 inclusive and DE11-15 inclusive |

| Earl Shilton Building Society Progress savings account | 0.6% | £100 minimum initial deposit. Only available to people living within the postcode areas of LE, CV9-13 inclusive and DE11-15 inclusive. Maximum of six withdrawals per year, otherwise rate is reduced to 0.1% AER |

| Charter Savings Bank Easy Access Cash Isa | 0.56% | £5,000 minimum initial deposit |

| Investec Bank plc Online Flexi Saver | 0.55% | £5,000 minimum initial deposit |

*Expected Profit Rate. Source: Moneyfacts. Correct as of 7 January 2021, but rates are subject to change.

There are several terms you’ll need to bear in mind if you opt for any of these top-rate accounts.

Only those in the specified local areas are able to open new accounts with Earl Shilton Building Society at the moment. Its Progress savings account can only be opened by those aged between 18 and 49, and a maximum of six withdrawals are permitted per calendar year. If you make more withdrawals than this, the interest rate will be reduced to just 0.1%.

The accounts from Charter Savings Bank and Investec Bank plc have fewer restrictions, but the minimum initial deposit is far higher; both require savings of at least £5,000 to open an account.

Finally, the account from Al Rayan Bank doesn’t have any restrictions, other than requiring a £50 minimum initial deposit. But it’s worth noting that it’s a Sharia-compliant account, which means it pays an Expected Profit Rate (EPR), rather than interest.

This means the advertised rate isn’t guaranteed – however, we’ve never heard of an instance in the UK where an Islamic bank has not paid out the savings rate that’s been advertised.

Top notice accounts

Top notice accounts can sometimes offer better rates than instant access deals, but you have to wait a certain amount of time until the cash is released to you.

So, if you know you’re likely to need quick access to cash this kind of account might not be for you.

The most common notice terms are 30, 60, 90 and 120 days. The table below shows the top rates for notice accounts.

| Account | AER | Terms |

| Charter Savings Bank 120-Day Notice | 0.63% | £5,000 minimum initial deposit |

| Hodge Bank 90-Day Deposit Account | 0.6% | £1,000 minimum initial deposit |

| Chorley Building Society 60-Day Notice Account | 0.55% | £1 minimum initial deposit |

| Aldermore 30-Day Notice Account | 0.55% | £1,000 minimum initial deposit |

Source: Moneyfacts. Correct as of 7 January 2021, but rates are subject to change.

As the table shows, you won’t be rewarded with much more interest if you opt for a 120-day notice account versus a 30-day account.

The majority of these top-rate accounts require you to save at least £1,000, which might not suit those with smaller savings pots.

- Find out more:how to find the best savings account

How to make your savings earn more

One of the best ways to ensure your savings can earn as much as possible, without relinquishing all access to them, is to split up your pot into a few different accounts.

It’s good practice to put aside some ’emergency savings’ into an instant-access account, so there’s cash to hand when you need it – perhaps in the case of redundancy, or unexpected expenses such as needing car repairs or a new boiler. As a rule of thumb, these savings should cover around three months of essential spending.

With anything leftover, you could then lock it away in a fixed-rate account – having some cash to hand means you’re more likely to be able to leave the rest of it locked up for the duration of the term.

If you’re feeling organised, you might want to take on our fixed-rate savings hack where you’ll eventually have money freed up from higher-rate five-year fixed-rate accounts every year. The diagram below shows how this can work:

Should I switch to a new savings account?

If your savings are held in an account paying no interest, they will lose value in real terms due to the effects of inflation.

Inflation measures the price changes of hundreds of different popular products and services from month to month; the most recent figures showed that the Consumer Prices Index (CPI) measure of inflation measured 0.3% in November 2020.

This means that the price of buying all of the products and services had increased by 0.3% between November 2019 and November 2020.

So say you’d saved the exact amount to buy all of the products and services in November 2019, if your money didn’t earn any interest over the next year it would no longer be able to buy everything as the prices had increased but your cash hadn’t. This is how inflation erodes the value of your savings.

However, before you take the plunge there are a few things you should consider:

- Does the account suit your circumstances? As mentioned, if you opt for a fixed-rate account you must be sure that you can stick to the term, as some providers will make you pay an interest penalty if you ask for early access.

- Can you afford the minimum initial deposit? Many of the top-rate accounts require you to deposit at least £1,000 just to open the account – there are lots of others that only require £1, but make sure you check before you open an account.

- Have you checked the terms? It’s not just the deposit you need to consider; some accounts come with extra terms such as bonus interest periods and withdrawal restrictions – make sure you know how the account works before you open it.

- Does the provider offer the kind of service you want? If you know you prefer to have the option of going in-branch, an online-only provider may not suit you. Similarly, if you want cutting-edge banking apps then you should look for providers that can give you this.

High Savings Account 3% Apy

Which? Limited is an Introducer Appointed Representative of Which? Financial Services Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 527029). Which? Money Compare is a trading name of Which? Financial Services Limited.

Only $100 to Open

Whether you’re saving for something specific or just a rainy day, a PNB savings account can help your money grow. All you need is $100 to open a PNB savings account.

This basic savings account offers a variable rate of interest, which is earned on the daily collected balance and credited quarterly. There is no monthly/quarterly maintenance fee for those maintaining a daily balance of $100; lower balances will incur an $8 quarterly fee.

The savings account also allows nine debits per quarter at no charge, though excess debits are $3 each.

Pnb Saving Account Interest Rate 2021

Current Interest Rates

Pnb Saving Account Interest Rate 2020

| Product | Min. Opening Deposit | Interest Rate | APY* |

|---|---|---|---|

| Savings | $100.00 | 0.020% | 0.020% |

7% Interest Rate Savings Account

Features

Saving Account Interest Rates Pnb

- Debit Card

- Notary service

- Touchtone teller

- Internet banking