T Mobile Savings Account

Minimum deposit requirement: $100. Minimum balance required to avoid fee: $0. It is an all-mobile national bank, so for those looking to save and don't mind banking completely over the phone or online, the Varo Savings Account makes a good option.

- Devices sold for use on T-Mobile prepaid service are to be activated on that service, not transferred for resale, modification, or export. Stateside International Talk/Text: International calling from U.S./Canada/Mexico to landlines in over 70 countries and destinations, plus unlimited calling to mobiles in over 30 countries.

- T-Mobile Health Savings Account (HSA) 346 employees reported this benefit. Updated Jul 20, 2017.

We believe in delivering the perfect client experience and place the highest priority on protecting your confidential information. For security purposes, we have temporarily suspended online access to your account.

To access your account, please:

- Visit a BB&T branch or ATM

- Log in to the U by BB&T® mobile app

- Send a text to MYBBT (69228) (if you have a mobile number registered with BB&T)

- Call our online banking support at 888-228-6654 and provide us the reference code below

Reference Code: (18.e4b2f748.1615063387.8732c37)

Thank you for your patience, and please accept our apologies for any inconvenience this may have caused.

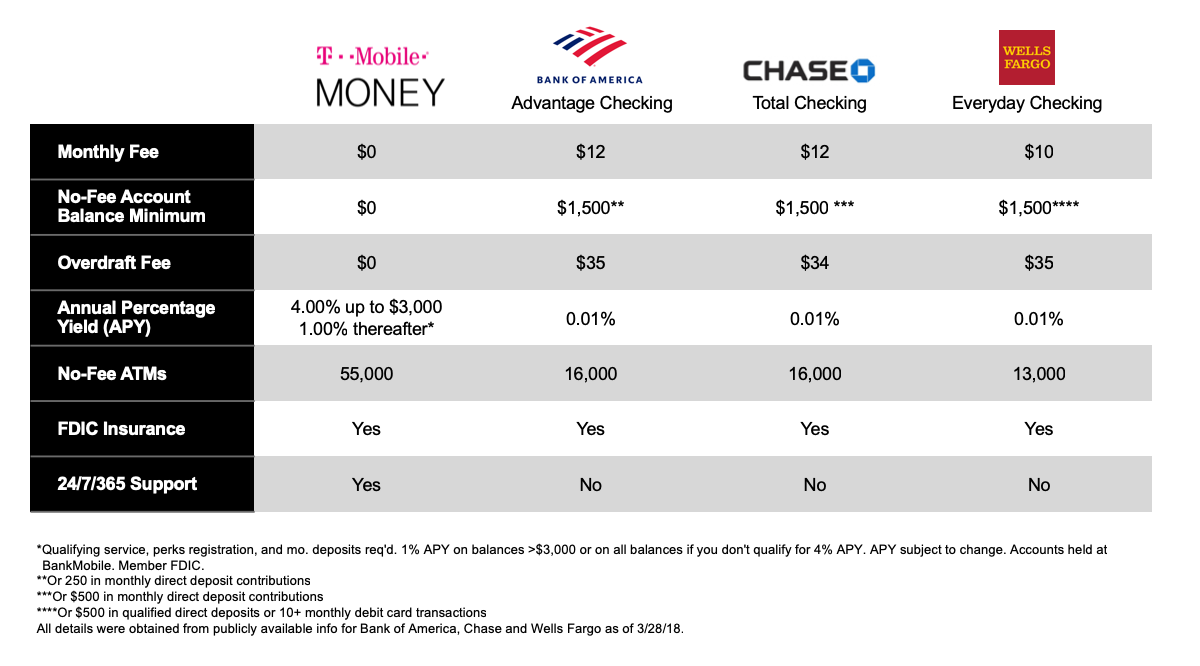

We love our customers, and we want to offer them better MONEY. So we've built a checking account where you can get paid up to 2 days early⁺ with payroll-related direct deposits and everyone earns 1.00% Annual Percentage Yield (APY)* on all balances. Plus, T-Mobile wireless customers with an eligible postpaid plan who register for perks and deposit at least $200 a month earn 4.00% APY* on balances up to $3,000 and 1.00% APY after that. Please see “How APY works” footnote below for an important upcoming change.

T-mobile Savings Account Reviews

Everyone gets access to over 55,000 no-fee Allpoint® ATMs in the U.S. and abroad (more than Bank of America, Chase or Wells Fargo) and our no overdraft fee, no account fee, no maintenance fee, and no minimum balance requirement checking account.

T Mobile High Interest Savings Account

To see what you're eligible for, log in to the T-Mobile MONEY app and select 'My perks'.

⁺Subject to description and timing of the employer payroll-based direct deposit, we typically make funds available the business day received, which may be up to 2 days earlier than scheduled.

T-mobile Money Open Account

* How APY works: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking Account per month when: 1) you are enrolled in a qualifying T-Mobile postpaid wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) As of today: at least $200 in qualifying deposits have posted to your Checking Account before the last business day of the month. Deposits posting on or after the last business day of the month count toward the next month’s qualifying deposits. Promotional deposits are not eligible toward the $200 in deposits. If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. This added value is subject to change. Balances above $3,000 in the Checking Account earn 1.00% APY. The APY for this tier will range from 4.00% to 2.79% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 1.00% APY on all Checking Account balances for any month(s) in which they do not meet the requirements listed above. APYs are accurate as of 5/29/2020, but may change at any time at our discretion. Fees may reduce earnings. For more information, see Account Disclosures / Terms and Conditions. PLEASE NOTE - Requirement #3 above will be changing. On March 31st, 2021, instead of the current qualifying deposit requirements, we will require that at least 10 qualifying purchases using your T-Mobile MONEY card have posted to your Checking Account before the last business day of the month. Qualifying purchases posting on or after the last business day of the month count toward the next month’s qualifying purchases. If you meet this purchase requirement in a given month, we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. An email notification will be sent to all current T-Mobile MONEY customers 30 days prior to the effective date of this change. Please see the FAQ “What is a 'qualifying purchase'?” for additional details.