Westpac Term Deposit Interest Rates

- Anz Term Deposit Rates Today

- 4% Interest Rate On Deposits

- Westpac Term Deposit Interest Rates

- Cba Term Deposit Rates Today

- Westpac Term Deposit Interest Rates Nz

Rate is applicable for a the period greater for deposit $5,000 to $249,999 The rate of 1.75% is 0.01% higher than the average 1.74%. Also it is 0.65% lower than the highest rate 2.40 Updated Aug, 2019. Term Deposit options from 30 days to 5 years – invest $5,000 or more for a fixed timeframe and earn a competitive fixed interest rate. Term Deposit Westpac NZ COVID-19 Level 3 - Auckland Branches.

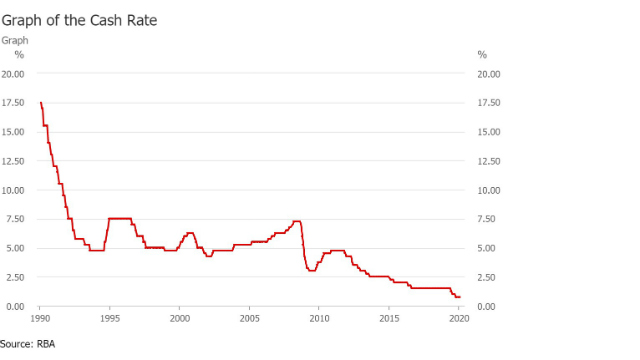

A Westpac term deposit is a type of savings product provided to personal banking customers for saving. It allows customers to investment money for a fixed interest period with terms ranging from 1 to 5 years with interest paid monthly or at maturity. Westpac business term deposit interest rates vary based on the term and interest payment frequency that you select. If you are a Westpac customer and use online banking, you can apply for a Westpac business term deposit online. Just back in 2009, the average big four term deposit rate was 5.25%, when the RBA cash rate was 7.2%. In fact, a few decades ago you could get your hands on a term deposit with an interest rate of 17%. Today’s deposit rates really pale in comparison with interest rates.

You may be eligible for a bonus rate on top our standard rates

Why do I need to sign in to Online Banking to check my rates?

In the past our bankers may have helped you get discretionary rates over the phone or in branch; now you can find out if you’re eligible for discretionary rates by signing into Online Banking.1

Rates may be based on factors such as your relationship with the bank and your existing balances.

You could get higher returns on your surplus cash with our range of fixed term deposits.

Our current term deposit rates are shown below. Look out for our latest special rates marked in red. You should note that:

- Information is current as at 4th June 2019

- Rates for new or renewal term deposits are subject to change at any time. However, once a term deposit account is opened the rate applicable to the account will not change unless the deposit or any part of it is repaid early

- Special rates are not available in conjunction with any bonus interest or other special rates offered by the bank.

Rates shown for a term, e.g. month(s) or year(s) apply up to the start of the next term shown.

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% |

| 2 < 3 months | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% |

| 3 < 4 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 4 < 5 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 5 < 6 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 6 < 7 months | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% |

| 7 < 8 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 8 < 9 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 9 < 10 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 10 < 11 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 11 < 12 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 12 < 24 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 24 < 36 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 36 < 48 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 48 < 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% |

| 2 < 3 months | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% |

| 3 < 4 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 4 < 5 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 5 < 6 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 6 < 7 months | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% |

| 7 < 8 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 8 < 9 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 9 < 10 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 10 < 11 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 11 < 12 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 12 < 24 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 24 < 36 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 36 < 48 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 48 < 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

For rates on other balances, terms and interest payment frequencies please call 132 142 (8am-8pm, 7 days a week).

Interest options are:

- Interest paid at maturity is available for terms of 12 months or less

- Interest paid monthly is available for terms of 1 to 60 months (inclusive)

- Interest paid annually is available for terms of greater than 12 months (for terms not equalling an exact year, the remaining interest is paid at the end of the term).

If some or all your business term deposit is repaid early:

- In most cases an interest rate adjustment will apply

- We reserve the right to vary the interest rate adjustment at any time

- If interim interest has been paid and the Term Deposit is repaid before maturity, we reserve the right to recover repayment of this interest

- No interest will be paid if the Term Deposit is repaid within the first 7 days of a Term.

The interest rate adjustment will not apply where a term deposit is repaid prior to maturity due to the death of the depositor.

Call us on 132 142 or visit a branch:

- To invest amounts over $250,000

- If you want to open a Term Deposit for a term other than those shown above.

Manage your Term Deposit online:

- Westpac Live allows you to manage your eligible Term Deposits online during the Six Business Day Variation Period.

Business Term Deposit

No set-up, monthly service or management fees (other fees may apply)

Open a Business Term Deposit

It only takes 10 minutes

Renew your Term Deposit online

Manage your eligible Term Deposit online during the Six Business Day Variation Period

Things you should know

Important Information Document (PDF 119KB)

1. Any discretionary rates offered above may only be available through Westpac Live Online Banking.

Customers must provide a minimum 31 days' notice to access funds prior to maturity (except in cases of hardship). If the rate applying to your term deposit is a special or standard rate and your term deposit rolls over automatically, it may be automatically re-invested at a lower rate than the initial rate (including any initial special rate).

Early withdrawal may reduce returns. Term Deposits are 'protected accounts' under the Financial Claims Scheme (FCS). Payments under the FCS are subject to a limit for each depositor. For more information see the APRA website at apra.gov.au. This information does not take into account your personal objectives, financial situation or needs. Read the Terms and Conditions (PDF 3MB) and Important Information Document (PDF 119KB) before making a decision and consider whether the product is appropriate for you. Other fees, charges, terms and conditions apply.

You may be eligible for a bonus rate on top our standard rates

Why do I need to sign in to Online Banking to check my rates?

Anz Term Deposit Rates Today

In the past our bankers may have helped you get discretionary rates over the phone or in branch; now you can find out if you’re eligible for discretionary rates by signing into Online Banking.1

Rates may be based on factors such as your relationship with the bank and your existing balances.

You could get higher returns on your surplus cash with our range of fixed term deposits.

Our current term deposit rates are shown below. Look out for our latest special rates marked in red. You should note that:

- Information is current as at 4th June 2019

- Rates for new or renewal term deposits are subject to change at any time. However, once a term deposit account is opened the rate applicable to the account will not change unless the deposit or any part of it is repaid early

- Special rates are not available in conjunction with any bonus interest or other special rates offered by the bank.

Rates shown for a term, e.g. month(s) or year(s) apply up to the start of the next term shown.

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% |

| 2 < 3 months | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% | 1.40% |

| 3 < 4 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 4 < 5 months | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

| 5 < 6 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 6 < 7 months | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% | 1.75% |

| 7 < 8 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 8 < 9 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 9 < 10 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 10 < 11 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 11 < 12 months | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% | 1.55% |

| 12 < 24 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 24 < 36 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 36 < 48 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 48 < 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 60 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| Term | $5,000 <$10,000 | $10,000 <$20,000 | $20,000 <$50,000 | $50,000 <$100,000 | $100,000 <$250,000 | $250,000 <$25,000,000 |

|---|---|---|---|---|---|---|

| 1 < 2 months | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% | 1.20% |

| 2 < 3 months | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% | 1.35% |

| 3 < 4 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 4 < 5 months | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% | 1.95% |

| 5 < 6 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 6 < 7 months | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% | 1.70% |

| 7 < 8 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 8 < 9 months | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% | 1.45% |

| 9 < 10 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 10 < 11 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 11 < 12 months | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% |

| 12 < 24 months | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% | 1.90% |

| 24 < 36 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 36 < 48 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 48 < 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

| 60 months | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% | 1.85% |

For rates on other balances, terms and interest payment frequencies please call 132 142 (8am-8pm, 7 days a week).

Interest options are:

- Interest paid at maturity is available for terms of 12 months or less

- Interest paid monthly is available for terms of 1 to 60 months (inclusive)

- Interest paid annually is available for terms of greater than 12 months (for terms not equalling an exact year, the remaining interest is paid at the end of the term).

If some or all your business term deposit is repaid early:

- In most cases an interest rate adjustment will apply

- We reserve the right to vary the interest rate adjustment at any time

- If interim interest has been paid and the Term Deposit is repaid before maturity, we reserve the right to recover repayment of this interest

- No interest will be paid if the Term Deposit is repaid within the first 7 days of a Term.

The interest rate adjustment will not apply where a term deposit is repaid prior to maturity due to the death of the depositor.

Call us on 132 142 or visit a branch:

- To invest amounts over $250,000

- If you want to open a Term Deposit for a term other than those shown above.

Manage your Term Deposit online:

- Westpac Live allows you to manage your eligible Term Deposits online during the Six Business Day Variation Period.

Business Term Deposit

No set-up, monthly service or management fees (other fees may apply)

4% Interest Rate On Deposits

Open a Business Term Deposit

It only takes 10 minutes

Renew your Term Deposit online

Manage your eligible Term Deposit online during the Six Business Day Variation Period

Things you should know

Important Information Document (PDF 119KB)

Westpac Term Deposit Interest Rates

1. Any discretionary rates offered above may only be available through Westpac Live Online Banking.

Cba Term Deposit Rates Today

Customers must provide a minimum 31 days' notice to access funds prior to maturity (except in cases of hardship). If the rate applying to your term deposit is a special or standard rate and your term deposit rolls over automatically, it may be automatically re-invested at a lower rate than the initial rate (including any initial special rate).

Westpac Term Deposit Interest Rates Nz

Early withdrawal may reduce returns. Term Deposits are 'protected accounts' under the Financial Claims Scheme (FCS). Payments under the FCS are subject to a limit for each depositor. For more information see the APRA website at apra.gov.au. This information does not take into account your personal objectives, financial situation or needs. Read the Terms and Conditions (PDF 3MB) and Important Information Document (PDF 119KB) before making a decision and consider whether the product is appropriate for you. Other fees, charges, terms and conditions apply.